Driveaway insurance refers to a short-term or temporary car insurance policy that allows you to legally drive a newly purchased vehicle before you have a permanent annual policy. So, it includes coverage of a few hours or days or sometimes a year. It is offered to facilitate you taking the vehicle from the dealership to home or until you arrange regular car insurance. It is also called “Temporary Car Insurance.” It protects you from accidents, theft, or other risks from day one.

Understanding GAP insurance: What It Covers (and What It Doesn’t)

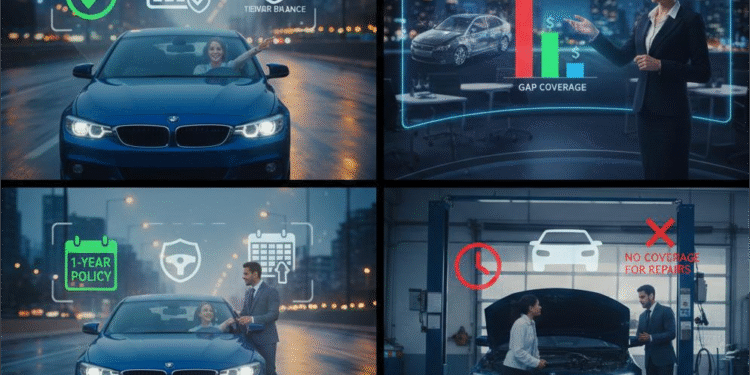

GAP (Guaranteed Asset Protection) insurance is an optional car insurance that covers the “gap” between a vehicle’s total loss value and the amount still owed on the loan or lease. If a financed or leased car is damaged or stolen, standard insurance only pays for the car’s depreciated market value, which may be less than the outstanding loan balance. It is different than driveaway or regular insurance policies, but they often consider it close.

Here’s how GAP insurance works:

- If your vehicle is not repairable or costs more than it’s worth by accident or is stolen, your standard auto insurance will typically pay out based on the car’s actual cash value (ACV) at that moment. This amount may be substantially lower than what you originally paid or still owe.

- If you financed or leased the car, you may owe more to the lender than the ACV. GAP insurance covers the “gap” between what you owe and what your insurer pays.

- This coverage is most useful early in the loan or lease period when depreciation is excessive and the “gap” between loan balance and market value is likely biggest.

There are also limitations in GAP insurance, as it only pays when the car is declared completely damaged or stolen. It does not cover other minor or major mechanical issues, regular wear and tear, or partial repairs.

There is also a specific condition in GAP insurance. By virtue of this policy, the insurance amount is not paid out if the loan balance is equal to or less than the car’s value; then there is no “gap.” Further, policy doesn’t allow coverage for negative equity rolled over from a previous loan. Some GAP policies may exclude negative equity from trade-ins or prior finance agreements.

How Much Does GAP Insurance Cost: Is It Worth It?

The cost of GAP insurance depends on how and where you purchase the vehicle. According to recent data, standalone GAP coverage from an insurer often costs around $50–$60 per year if added to an existing comprehensive and collision insurance policy.

By contrast, buying GAP insurance through a car dealership is often found to be more expensive. Sometimes up to several hundred dollars per year, or rolled into the loan, increasing your interest costs.

Whether GAP is “worth it” depends on your situation: if you made a small down payment, financed much of the car, or the loan term is long (e.g., 60 months or more), then GAP can offer valuable protection, especially in the first 1-2 years.

If you pay most of the car instantly or your loan balance is low compared to the vehicle value, GAP may not make financial sense.

How to “Find Out If I Have GAP Insurance”

You can check whether your policy contains GAP coverage or otherwise by adopting the following methods:

- Many lenders require or offer GAP when financing or leasing.

- Check the declarations page of your auto insurance policy. If GAP is included, it will be listed under “loan/lease payoff coverage,” “GAP endorsement,” or a similar designation.

- If you buy a new or used car, ask your dealer directly, but be aware that dealer-offered GAP insurance tends to cost more.

If you don’t have GAP but want it, many insurance companies will let you add it as often for a modest annual fee, especially if the car is new and financed.

When Might GAP Insurance Not Pay Out

You should also know other significant features of GAP insurance, as it doesn’t guarantee a payout under all circumstances. Due to some common reasons, a claim may be denied or reduced:

- The vehicle wasn’t declared a total loss, e.g., if damage is repairable or partial. GAP doesn’t cover repairs.

- The loan balance is lower than or equal to the vehicle’s actual cash value, as there’s no “gap”.

- Negative equity from a trade-in or previous loan was rolled into the new loan, and the GAP policy excludes such negative equity. Some policies don’t cover that, unless you paid for an additional “negative-equity add-on”.

- The policy had requirements you didn’t meet, e.g., you purchased GAP after a certain allowed period (often required soon after purchase), or you dropped the required comprehensive/collision coverage.

In a nutshell, although GAP insurance is a safety network, it is only under some specific circumstances. So always read it carefully at the time of buying.

Driveaway Insurance, and Other Related Terms

It is also necessary to discuss other useful insurance terms, so the same is given hereunder:

- Driveaway (or temporary) insurance helps when you just buy a vehicle and need immediate but short-term coverage. It includes a few days or weeks until you finalise long-term coverage.

- A “1-year car insurance policy” is the common long-term coverage people buy once settlement with the dealer or lender is complete.

- For business, commercial auto or commercial insurance if the car is used for business or transport purposes.

Is GAP (or Driveaway) Insurance Worth It:

Before you intend to GAP or driveaway insurance, consider these points minutely:

- How much did you finance vs how much did you pay upfront? A small down payment or long loan term increases your risk of negative equity.

- How soon after purchase are you buying GAP? Many providers require purchase of GAP insurance early, especially for new cars.

- What does the policy cover exactly? Does it cover negative equity? Does it have a cap or limit? Does it cover the deductible or only the gap?

- What’s the cost relative to the protection? A modest annual fee with good coverage may be worth it but expensive dealer-offered GAP might not be justified.

- Do you need temporary “driveaway” coverage? If you just purchased the vehicle and haven’t arranged full insurance yet, driveaway coverage can protect you in that gap.

Final Thoughts: –

Driveaway insurance and GAP insurance are two different policies, but both are useful, especially when financing or leasing vehicles. Driveaway insurance protects you in the short term for the immediate journey after purchasing, whereas GAP insurance offers longer-term protection against depreciation and negative equity, particularly valuable in the first years when the difference between what you owe and the car’s value tends to be largest. For many buyers, especially those financing their purchase, GAP insurance can provide peace of mind. And for the newest car buyers, driveaway coverage ensures you are not driving unsecured from the showroom to home.